A planned $15 billion safety overhaul of ageing rail network is facing delays as the country’s state steel company is unable to meet demand for new rails, according to two government documents seen by Reuters.

State-owned Steel Authority of India Ltd (SAIL) has promised to meet only around 78 per cent of demand in the year to end-March 2018, prompting Indian Railways to escalate the problem to the office of Prime Minister Narendra Modi, communications between the railways and the steel ministry show.

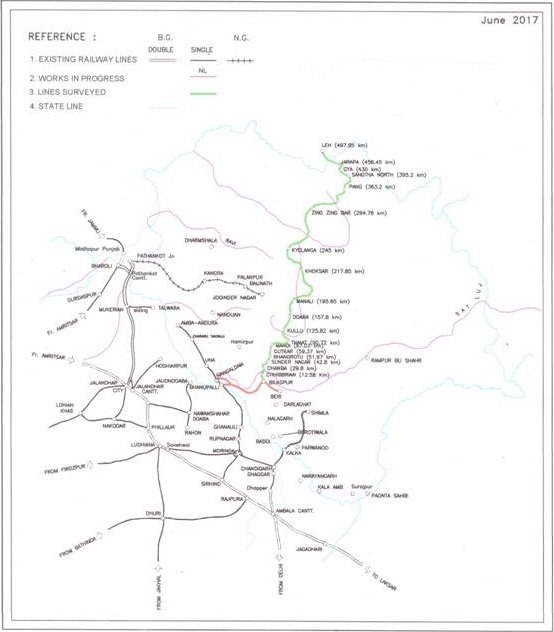

The shortfall means upgrades of the accident-prone network could move at a slower pace than the five years initially planned, and underscores the problems facing Modi as he tries to modernize India’s infrastructure. Supplies of rails are only expected to improve next year.

“(The) ambitious programme of capacity augmentation undertaken by railways and track renewal, the foremost priority in the recently created (railway safety fund) … crucially hinges on the supply of rail,” Railways Board Chairman A.K. Mital wrote in a letter to Steel Secretary Aruna Sharma on May 19.

“Unless SAIL steps up supply, the whole programme will be at risk.”

The state rail operator is in the middle of a $130 billion, five-year overhaul to modernise the world’s fourth-biggest network.

The government in February launched an additional $15 billion fund to tackle a 25 percent rise in train accidents due to track defects over the past two years.

Loss-making SAIL, whose revival is being managed by the steel ministry, supplied about 620,000 tonnes of rails in the fiscal year to end-March, well short of demand of 1 million tonnes. In a meeting called by Modi’s office on February 14, SAIL told the railways that supplies would fall well short of demand this fiscal year too, according to the letter.

This represents about 78 per cent, but the rate of supplies for the first two months suggested SAIL would struggle to meet even its own reduced target, Mital said in the letter.

“The shortfall needs to be made good quickly and supply rate accelerated to meet the committed quantity (for this fiscal year),” Mital wrote.

SAIL and Modi’s office did not respond to requests seeking comment. The railways had no immediate comment and Mital did not respond to a request for comment.

SAIL MONOPOLY

Indian Railways have considered ending SAIL’s monopoly on supplying rail, but Modi’s cabinet in May made the use of local steel mandatory for government infrastructure projects, ruling out the use of imports.

Local firm Jindal Steel and Power Ltd has tried for years to win a rail supply contract, but is battling a long-standing preference by Indian policymakers for state companies over private firms for big-ticket government projects.

Executives at SAIL, which has lost money in the last seven quarters, have said a surge in demand to replace old tracks and lay new ones meant it was struggling to meet supply targets, despite a rise in production from its existing plant.

Steel secretary Sharma wrote to SAIL on May 29, in a letter seen by Reuters, noting that the railway upgrade was a “very important national project” and that “any shortfall in rail supplies to this project would be taken seriously”.

Sharma told Reuters a new SAIL mill at Bhilai, in eastern India, will help the steelmaker boost capacity, which should ease the rails deficit. SAIL has targeted total capacity of 2 million tonnes per year from its Bhilai plant.

“We are conscious about the concerns of the railway ministry but we have enough rail manufacturing capabilities within the country,” she said.