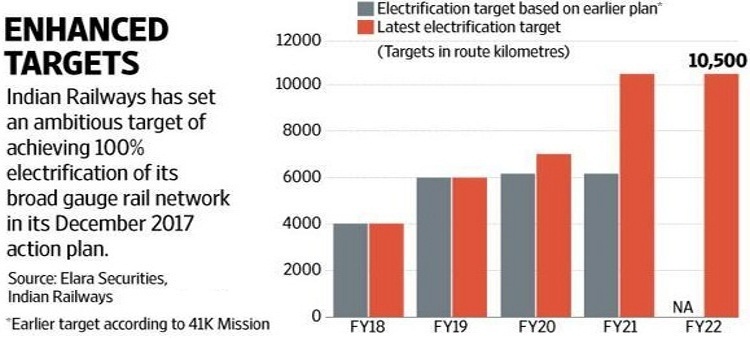

The Indian Railways’ target to electrify all its broad gauge tracks by fiscal year 2022 can open up large opportunities for engineering, procurement and construction (EPC) companies. The national carrier has prepared an action plan to electrify 38,000 route-kilometres in five years, incurring an expenditure of Rs.32,591 crore.

According to Elara Securities (India) Pvt. Ltd, the target represents a significant jump from an earlier plan. “The action plan’s target is 56% higher than an earlier plan of electrifying 90% of the network, or 24,400 route kilometres over FY17-21 announced in November 2016,” Elara Securities wrote in a note.

Importantly, the national transporter has plans to award individual tenders as large as 1,500km. The move would not only lower electrification costs due to better economies of scale but also make the tenders more appealing for large companies. Indian Railways has hitherto been awarding tenders for smaller lengths, making it a time-consuming process, according to a report.

Nevertheless, given the Indian Railways’ focus on capital expenditure and capacity augmentation, award of contracts is already on an upswing. Elara’s analysis of contract awards shows a sharp rise in the awarding of electrification projects in the first eight months of this fiscal.

If the Railways steps up the pace to achieve its renewed target, then capital goods and EPC services providers can see accelerated order inflows. “We believe EPC firms like Larsen and Toubro, KEC International, Kalpataru Power and T&D firms like CG (Crompton Greaves) Power, Siemens India and ABB India would be key beneficiaries,” Elara Securities said in a note. “We revise our EPS estimates on higher order inflows and pick-up in execution for ABB, CG Power, KEC International and Siemens.”

T&D is transmission and distribution, and EPS is earnings per share. Higher order flows will come as a welcome relief for capital goods and EPC companies that have been weighed down by weak trends in private sector capital expenditure. Stiff competition for these contracts does pose a risk, however.

The enlargement of contracts can raise competition, putting pressure on margins—akin to that being seen in the EPC business for the solar power sector. According to Elara Securities, Central Organisation for Railway Electrification (CORE), an arm of the railways that carries out electrification works, has sounded out empanelled vendors of government power utilities.

“This would be beneficial for Indian Railways in accelerating execution of electrification projects and foster competition by enhancing the vendor base,” Elara Securities adds. While the measures could indeed expand the vendor base of Indian Railways, it is only when the orders are eventually awarded that investors will know if the contracts are lucrative enough.