Channel checks by Jefferies India Pvt. Ltd indicate that the railways are gaining preference over roads for long distances, a positive for CONCOR given its dominant market share in the container rail movement.

“Our industry and company interactions suggest that railways are gaining gradual preference over roads for long distances,” Jefferies said in a note.

The question that begs clarity, however, is how much of this volume recovery will translate into earnings. Being a transporter, CONCOR will gain most when it keeps costs in check and resources are put to optimum use. Here, there is a challenge. One is empty running, due to the imbalance in the exim trade (more imports than exports), as pointed out earlier in this column. This leads to cost under-recovery. The second factor is the lead distance.

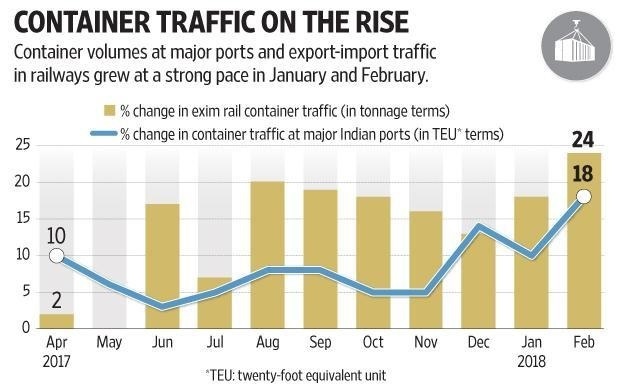

The latest container freight traffic data led to noticeable gains in the shares of Container Corp. of India Ltd, aka CONCOR. Compared to a 0.1% rise in the BSE 500 index, the stock gained 5% over the past week as data from major ports and the Indian Railways showed continuing recovery in export-import (exim) container volumes.

The recovery augurs well for container train operators such as CONCOR.

According to Motilal Oswal Securities Ltd, lead distance for the rail segment has been declining due to the increasing proportion of volumes from Mundra/Pipavav ports, which have lower lead distance to the northern part of the country. “This, in turn, has been adversely affecting realizations, and thus, margins. Lead distance for exim rail transportation declined by 30km MoM (month-on-month) in February, which may impact margins in 4QFY18,” Motilal Oswal Securities said in a note.

That said, the above mentioned challenges are nothing new for CONCOR. The company is trying to mitigate the empty running costs through double stacking and circuit networks, where the train will travel further down the destination to pick up return cargo.

This, coinciding with the better volumes, helped CONCOR in the December quarter. Further, with volumes remaining strong, some analysts believe the leverage benefits to outweigh the challenges, driving earnings. “In 3Q, just between higher double stacking to 492 trains from 216 trains YoY and 11% YoY volume growth, CONCOR’s exim Ebit margins improved 120 bps YoY to 18.3% from 17.1%,” analysts at Jefferies add. “Double stacking benefits should also play out in 4QFY18E (the fourth quarter of 2017-18) for the company.”

The stock is reflecting this optimism, trading at about 24 times FY19 earnings estimates. For it to maintain the positive momentum, the company should continue extract the best of volume growth, the results of which will soon be known in its quarterly earnings.